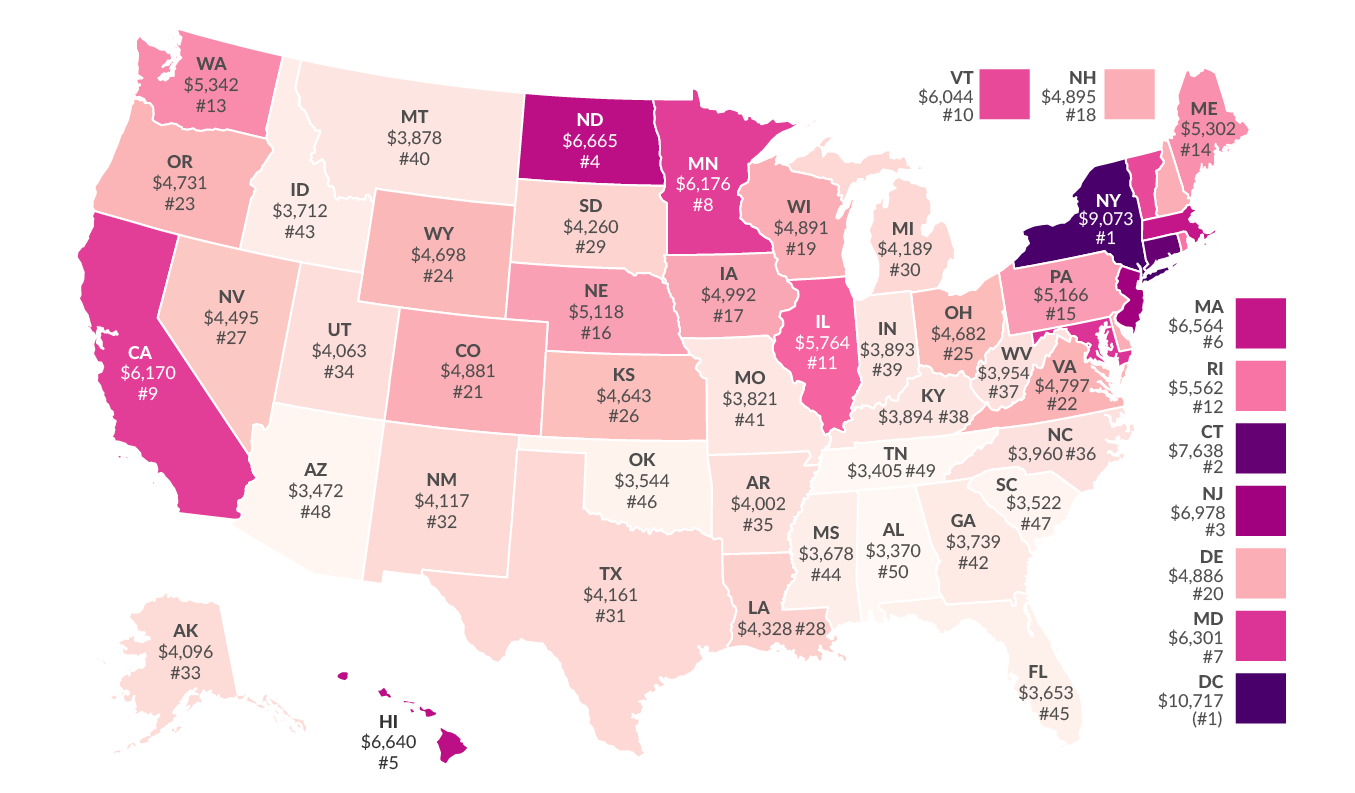

The latest state tax map prepared by the Tax Foundation shows state and local tax collections per capita in each of the 50 states and the District of Columbia.

The Tax Foundation reports that based on the latest data available (2017), tax collections in D.C. surpass those in any state, at $10,717 per capita. The five states with the highest tax collections per capita are New York ($9,073), Connecticut ($7,638), New Jersey ($6,978), North Dakota ($6,665), and Hawaii ($6,640). The five states with the lowest tax collections per capita are Alabama ($3,370), Tennessee ($3,405), Arizona ($3,472), South Carolina ($3,522), and Oklahoma ($3,544).

Of course, these state-level averages may hide considerable variation in the composition of state and local taxes across states, as well as potentially considerable variation of overall state and local tax collections within states.

As concentrations of tax bases–such as personal and corporate income, as well as retail sales and real property–tend to take place in major urban areas, one would expect states with major metropolitan areas (such as New York, California and Illinois) to have not only higher revenues per capita, but also have considerably greater variations of state and local revenue collections within the state.

Link here to read the original post on the Tax Foundation website.